- Posted bytsradmin

- Financial Content Writers, Content Writing- Forex Markets, Stock Market Content Writers, Forex Content Writing, Forex Broker Reviews, Financial Market Content Writing

- 0 Comments

TradeStation FX- Review of the trading software giant plus online broker

Our in-depth coverage of the TradeStation broker includes broking services, regulation, products, and the innovative trading tools offered to individuals and institutions.

About the TradeStation broker-

TradeStation is an online broking firm with a tech background. Until 2016, TradeStation broker was operating as IBFX Inc. before FX broker Oanda acquired all the forex trading accounts of the firm.

A member of the New York Stock Exchange and the Chicago Mercantile Exchange, TradeStation offers trading facilities in equities, ETFs, futures, and options for individuals and institutional investors in the US. However, to meet the growing demand for its platform from the International trading community, TradeStation is associated with Interactive Brokers as an introducing broker, providing its trading platform to IB’s customers, which is accessible across 120 global markets in 26 countries.

The company’s services cater to the self-directed community of traders at large, and their trading platforms and analytical tools can be accessed easily as a web browser, desktop, or mobile application. They also provide the Algo /Automated trading feature for traders to backtest their customized strategies in a risk- free environment before hitting the LIVE markets. TradeStation has an exhaustive Knowledge Centre loaded with Videos, Events, and Tutorials for fulltime/aspiring traders to succeed in the dynamic trading world.

Founded over three decades ago, TradeStation is now a wholly-owned subsidiary of the Monex Group Inc, a financial services conglomerate incorporated in Japan.

Headquartered in Florida (USA), TradeStation continues to serve its active trading clientele by providing them with world-class trading tools at their fingertips.

The key parameters considered in our review of TradeStation-

TradeStation operates two separate platforms: One for US citizens and the other for global customers.

In our extensive review of the TradeStation broker, we assess the broker on three different parameters.

- First, we cover the various regulators governing the broker, followed by the broker’s policies towards investor protection, client privacy, data, and the security of funds.

- In the second part of the review, we take a look at the account types offered by the broker for US and International clients, account opening procedure, the product list, trading platforms, and their features, leverage, trading costs comprising of the spread, commission, and other charges.

- The last part of the review includes the bonuses and promotions offered to clients, the awards received by the broker, the quality of customer support, and a few frequently asked questions about the TradeStation broker.

Since we are analyzing a large amount of data, and due to insufficient material or restrictions in gathering information, in some sections, we might confine our coverage of the broker either to the US or International markets only. However, irrespective of the products, features, or the target clientele, we have upheld a balanced review in our analysis of the TradeStation broker, keeping in mind the potential benefits for investors.

TradeStation account types and the registration process-

TradeStation’s account types come under five different categories for US residents, and caters to all kinds of participants, from minors to corporates. Individual traders, investors saving for their retirement, trusts, proprietary firms, partnerships, corporate entities, and others can all set up their accounts with TradeStation. TradeStation has not included the option of Islamic accounts for US residents.

Mentioned below are the TradeStation account types for US citizens-

- Individual account- This is a simple personal account in the name of an individual.

- Joint account- Two or more individuals can sign-up to open a joint account. TradeStation broker has two types of joint accounts.

- Joint with right of ownership- The ownership passes on to the other entities if any of the account holders pass away.

- Joint tenants in common- Ownership transferred to a designated beneficiary in the case of death of the account holder.

Individual Retirement Account (IRA)-

The IRA account with TradeStation broker is only for US taxpayers and mostly serves as a retirement account. These accounts are further sub-divided into four groups.

- Traditional IRA- An individual retirement account for beneficiaries to receive tax benefits.

- Roth IRA- An individual retirement account for beneficiaries to receive Roth IRA tax benefits.

- Sep IRA- A Simplified Employee Pension (SEP) IRA account where employers contribute to traditional IRAs set up for employees based on a written arrangement between the two.

- Savings Incentive Match Plan for Employees (SIMPLE) IRA- These are equity retirement IRA accounts to which employers make contributions and gain from tax benefits. Self-employed individuals can also use these IRA accounts.

Entity account-

The account types under the ‘Entity Account’ cater to all kinds of businesses operating from the US. Foreign firms opening an entity account could be subject to other laws and requirements.

The following are the different types of entity accounts with TradeStation.

- Sole Proprietorship- This accounts type is for businesses owned by an individual with 100 percent equity in the firm.

- Limited Liability Company- An LLC account is for firms that are typically operated by managing members.

- Trust- Legal entities formed by a grantor and administered by the trustee(s) to benefit selected recipients can open Trust accounts.

- Limited Partnership- This firm comprises of two or more partners.

- General Partnership- This account type is for partnership firms that are managed by general partners or partners.

- Corporate- These accounts are for corporations, and must be in the full legal name as in the articles or certificate of incorporation.

Custodial account-

These are equity accounts, managed by an adult on behalf of a minor.

Minimum deposit requirements-

The broker has prescribed minimum deposit requirements for all accounts, no exceptions here. TradeStation’s minimum deposit conditions depend on the instrument traded. Besides, there are separate margins on volumes and trading frequency, which we have highlighted in our review under margins, execution, and leverage.

Following are the initial deposits mandated by the broker

Stock and options: $500 for cash instruments and $2,000 for margin trading.

Futures and options on futures: $500

Account types at TradeStation International Inc-

TradeStation International Ltd is an introducing broker to Interactive Brokers (UK) Limited and its affiliates. International clients can now open an account with Interactive Brokers and use the TradeStation Global platform to trade in forex, equities, and futures across markets in the Asia Pacific, Europe, and North America. The initial deposit to open an account with TradeStation Global is $1,000 in cash or stock.

Interactive Brokers have six account types for all categories of customers, from individuals to institutions. The structure of each of the trading account is designed to meet the requirements of professional traders and investors. We have underlined all the account types below and also illustrated the account opening steps for individuals

- Individual account- These accounts can be set up by individuals, joint account holders, retirement, UGMA/UTMA.

- Trust account

- Single fund account

- Multiple funds account

- Financial Advisor

- Institution- These accounts are for partnership firms, Limited Liability Companies, Corporations, and Unincorporated firms.

Registration steps to open an Individual account with Interactive Brokers Global-

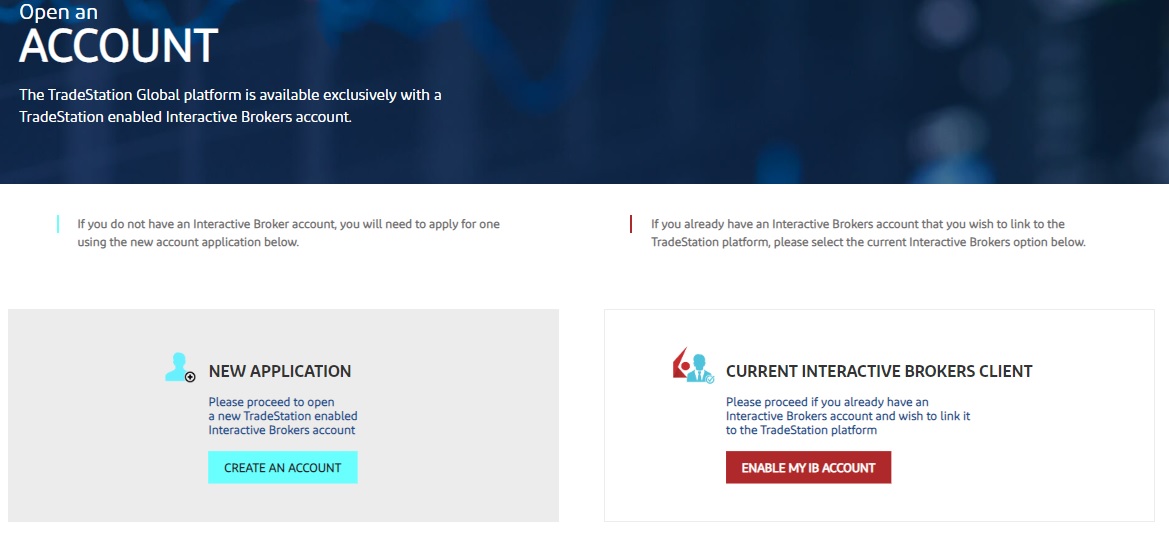

You can begin by clicking on the OPEN AN ACCOUNT button on the homepage. If you already have an account with Interactive Brokers and intend to link it to the TradeStation platform, you can do so, else, create a new account.

Fill out some basic information, confirm to the terms of the agreement, and continue

The next step is to choose your account type and continue

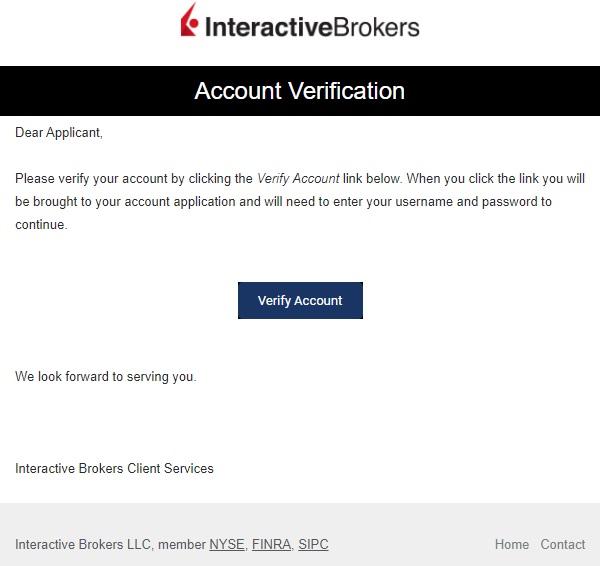

Register your account by choosing a username and password. You would then receive an Account Verification Email from Interactive Brokers, and on verifying your account, you would continue with the account opening process.

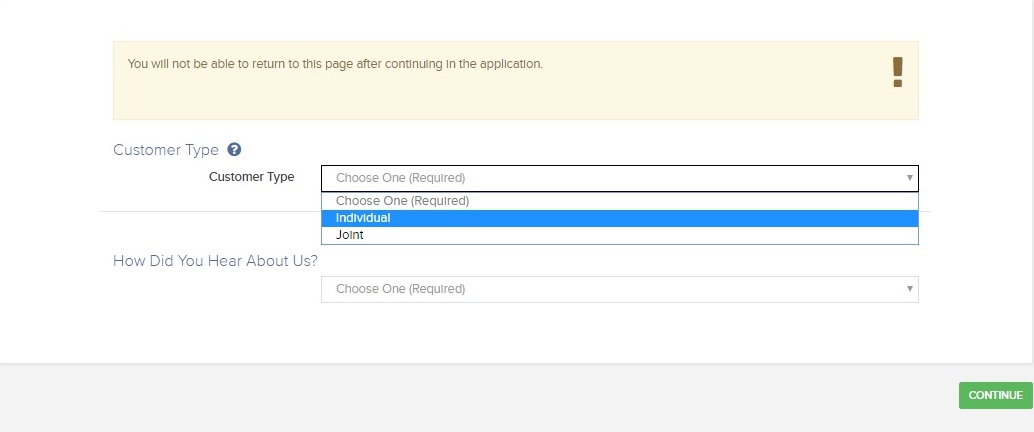

Enter the type of account you wish to open

Update your personal and account information.

Next, fill out the regulatory information, investment objective, trading permission, and experience

Confirm “Certificate of Tax Residences,” accept general agreements and disclosures

Review your application

To conclude your account opening process, confirm your mobile number, and either upload your KYC details or email them to newaccounts@interactivebrokers.com

You can also fax/post your KYC details to any of the branch offices of Interactive Brokers

| Pros | Cons |

|---|---|

| The account types at TradeStation and Interactive Brokers cater to almost all sections of the trading community. | The account opening process is very tedious. It could have been simpler. |

| A large cache of IRA and non-individual accounts for businesses operating in the US. | |

| Your TradeStation Global account gives you access to all the world’s major stock markets at the click of a button. |

Regulators governing TradeStation-

TradeStation Securities Inc. is a registered broker and a futures commission merchant operating from the United States. Since the TradeStation broker provides trading and investment services from the US for securities listed on US exchanges, it is licensed by the

- US Securities and Exchange Commission (SEC)

- National Futures Association (NFA) and

- Municipal Securities Rulemaking Board (MSRB)

- Financial Industry Regulatory Authority (FINRA)

Global clients setting up trading accounts with TradeStation International Ltd. are under the regulations of the Financial Conduct Authority (FCA) in the UK with passport rights to the countries in the European Economic Area (EEA).

Trading products-

Clients of TradeStation have access to a wide range of products across the broker’s web, desktop, and mobile platforms. Besides, US residents are offered commission-free trades on some of the product offerings. The trading products for clients registering with TradeStation in the US include Stocks, ETFs, IPOs, Options, Futures, Futures Options, Cryptocurrencies, Mutual funds, and Bonds. All the products are exchange-traded, including the TradeStation Crypto, an aggregator connecting multiple trading venues to TradeStation’s back-office.

Global clients accessing TradeStation via Interactive Brokers have the choice of equities, futures, and forex. Here’s a quick description of the trading instruments.

- Forex- TradeStation allows all its clients to trade in currencies, comprising 23 major and minor FX pairs with direct access to interbank quotes from 17 of the largest global banks dealing in FX and accounting for about 60% of the worldwide market share.

- Stocks- Investors and traders can monitor stocks across all the major markets in North America, Europe, and the Asia-Pacific from a single IB account.

- Futures- TradeStation Global, in association with Interactive Brokers, covers all the major futures exchanges. You can now trade individual futures contracts or include them into a broader portfolio hedging strategy comprising multiple assets.

The TradeStation platform-

The TradeStation platforms are accessible as web, desktop, and mobile trading applications and appropriate for all categories of traders- manual and automated. The platforms are compatible with Windows and Mac operating systems, with the browser-version supporting Internet Explorer or Edge browser. The other minimum system requirements include 8GB RAM, 400 MB free disc space, 32-bit video card, a broadband connection of at least 2Mbps, 32-bit operating system, and a screen resolution of 1280 X 1024 pixels.

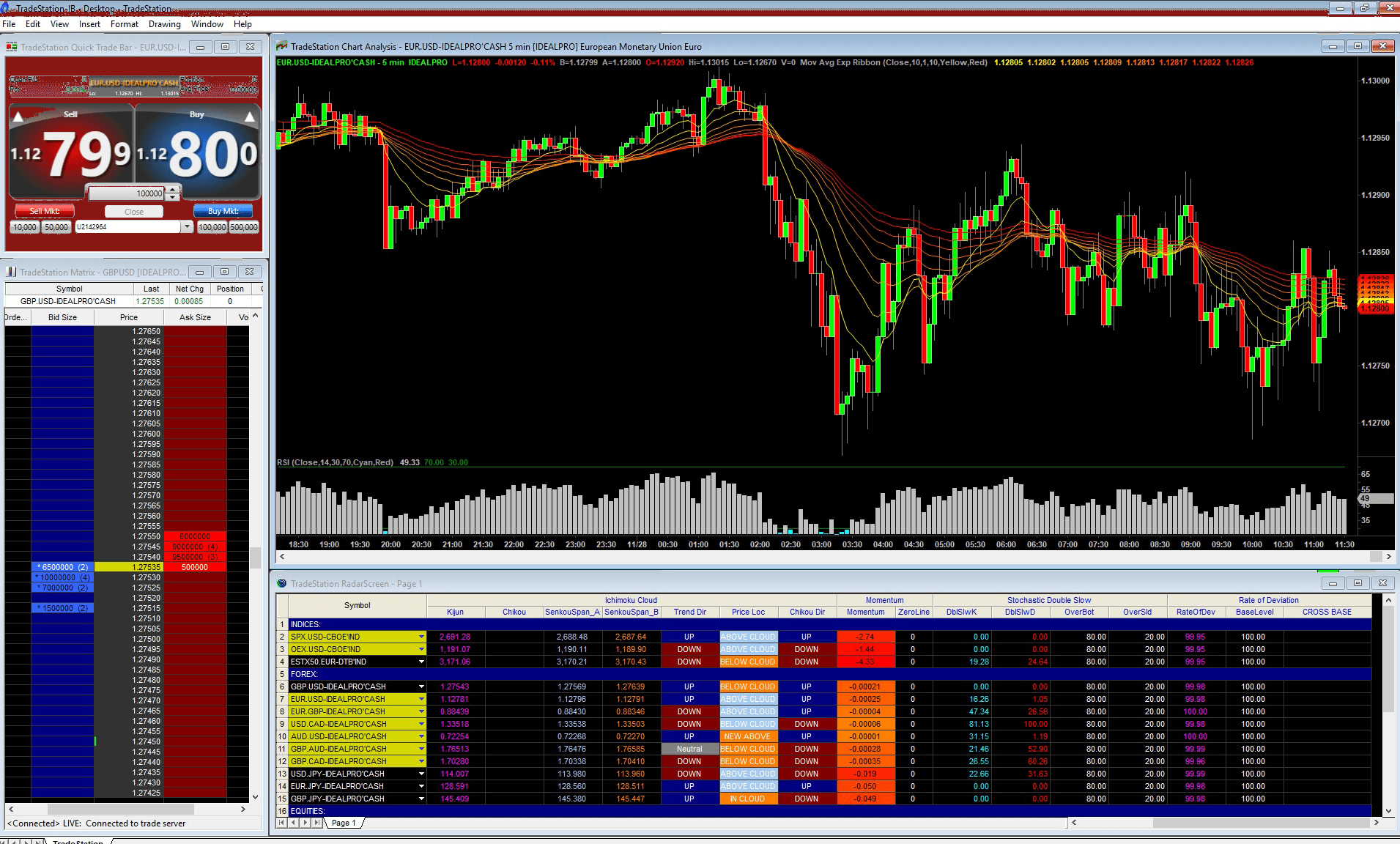

The client terminal supports fully customizable charting, cutting-edge order management tools, high-speed trade execution, and fully automated trading. The TradeStation platform is accessible free of cost

We were unable to review the platforms manually due to restrictions in setting up a demo account, so we did the next best thing, which is to highlight all the features.

The TradeStation desktop terminal-

The TradeStation’s latest desktop version 10 has advanced order management systems coupled with fast and reliable trade execution. The historical data of individual products dates back to tens of years, with the Dow data available from 1920. According to TradeStation, the trading systems have an uptime of 99.999%. Here are some useful features of the platform-

- Trade all the assets across spot and derivatives, including futures, options.

- TradeStation’s RadarScreen allows users to scan around 1000 symbols in real-time and look for trading opportunities from the 180 plus fundamental and technical analysis indicators.

- Options traders can visualize options chains across markets and test the probability of strategies across various contract expirations.

- You can program, backtest, and automate your trading ideas with TradeStation’s patented computer programming language, EasyLanguage.

- Access the in-built trading apps, or go to the TradeStation TradingApp Store to download hundreds of free apps.

The TradeStation web terminal-

The TradeStation web application allows you to trade multiple assets from any browser on your Mac or PC; all you need is an internet connection. The core features of the browser terminal are similar to the desktop platform offered by TradeStation, such as the RadarScreen, EasyLanguage, Matrix, and the Options chain. Besides, the web platform works in sync with TradeStation’s iOS and Android apps.

Following are some of the primary features of the web terminal-

- Streaming market data with compelling charts and several technical indicators.

- Real-time news.

- Watchlists and Hotlist trading instruments.

- You can monitor your account position, cash balance, and orders.

- Access to historical data.

- Ability to place high-speed orders.

The TradeStation Mobile App-

TradeStation is one of the top online trading apps for Apple, Android smartphone users. You can quickly download the iOS or the Android trading applications from the Apple App Store or the Google PlayStore even if you are not a TradeStation client.

Here are some of the features that set TradeStation apart from the competition-

- Monitor real-time prices, options greeks, and the volume info to boost your analysis.

- Add drawing tools and technical studies to identify chart patterns and trends.

- You can quickly choose the trade size, type, routing, and duration.

- Create multiple alerts to manage your trading, net change, VWAP, and volumes.

- You can view some of the popular options spread strategies or create your own.

- Place one tap orders directly from the Matrix window.

Key trading features offered by the TradeStation broker-

The TradeStation terminal comprises several analytical tools like scanners, market depth, order entry, order tracking, and EasyLanguage tools. Here’s a quick description of some of the primary tools that assist traders in monitoring the markets efficiently.

RadarScreen-

A real-time market scanner that tests hundreds of trading symbols based on tens of hundreds of technical indicators plus custom settings and alerts you of trading opportunities whenever they arise. You can employ RadarScreen to dynamically rank symbols in real-time, besides creating custom and visual alerts.

Matrix-

A dynamic market depth window of the best bids and offers with the choice to place one-click orders.

EasyLanguage-

The TradeStation programming language for individuals looking to carry out automated trading on the platform. The proprietary code, developed by programming experts comprises of different levels- beginners to experts and is free of cost to traders. Besides providing the EasyLanguage Essential, an online material to study the language, TradeStation offers four, free code downloads that include

- Intermarket divergence

- Moving average crossover

- EquityCurve

- Pivot Point Zone Code

FuturesPlus-

TradeStation, in association with Trading Technologies, provides derivatives traders the choice of an institutional-grade futures options platform. Investors can use the free trading terminal to strategize their trades on some of the leading financial exchanges, including the CME and ICE. Coupled with competitive day trading margin rates, zero commissions, and free-market data, experience high-speed order execution on the all-powerful trading platform, accessible on PCs and mobile devices.

Simulated trading-

Test strategies in real-time without risking your capital, using TradeStation’s simulated trading application. All this on decades of historical market data on one of the distinguished trading platforms of all time.

Web API-

A portal that permits users to access third-party trading applications that run independently but use TradeStation’s market data and order execution systems. Some of these programs include TradingView, VectorVest, Bookmap, and Dynamic Trend.

Margins, execution, and leverage-

Since TradeStation is a member of FINRA, the margins and leverage offered by the brokerage have to conform to the rules set by the regulatory authority. However, clients of TradeStation Global would be using TradeStation with Interactive Brokers, with the margins and leverage varying according to the products and the markets where they are trading.

If you are trading with the TradeStation broker in the US, here is how your margins, trading, and minimum balance requirements are determined.

- Non-Day Trading Margin Accounts:

These trading accounts restrict the total number of new open positions to a maximum of three transactions per day minus the number of day trades carried out in the previous four trading sessions.

For instance: If you have carried out two-day trades in the preceding four sessions, you can place only one new opening transaction (long/short) on the current day. However, you would be able to close out trades by placing sell/ cover orders.

- Pattern Day Trading Margin Accounts:

FINRA day trading rules state that any account in which there were four day-trades during a fiveday-period is a “pattern day trading” account, and account holders are required to maintain a minimum daily balance of $25,000. If the cashfalls below the minimum required balance, trading is constrained to only closing out transactions until the account balance heads back to $25,000.

Charges: Spread, commissions, and fees-

If you are trading with TradeStation on the US exchanges, you would be subject to the spreads displayed by the corresponding financial exchanges rather than by the brokerage itself.

On the commission front, TradeStation broker has multiple slabs, and they differ for stocks, ETFs, options, futures, mutual funds, and fixed income instruments.

If you’re trading stocks and ETFs, the broker has three commission plans

- A flat commission of $5 per trade for stocks and ETF’s. Add the regulatory and trading activity fee, and the charges can go up to $5.95 per trade.

- For regular traders, the commissions start at 1c per share.

- The applicable cost for high volume traders could be as low as $0.002 per share (including execution rebates).

- US residents opting for TradeStation Select and TradeStation GO are allowed commission-free trades in equities up to 10,000 shares per trade. For orders beyond 10,000 shares, TradeStation charges a commission of $0.005 percent per share. Also, clients directly routing equity orders would have to pay an additional $0.005 per share.

If you are an options trader, TradeStation has two commission structures-

- Pay $5 per trade plus $0.50 per contract.

- For regular traders who trade in small blocks, the TradeStation broker charges a commission of $1 per contract.

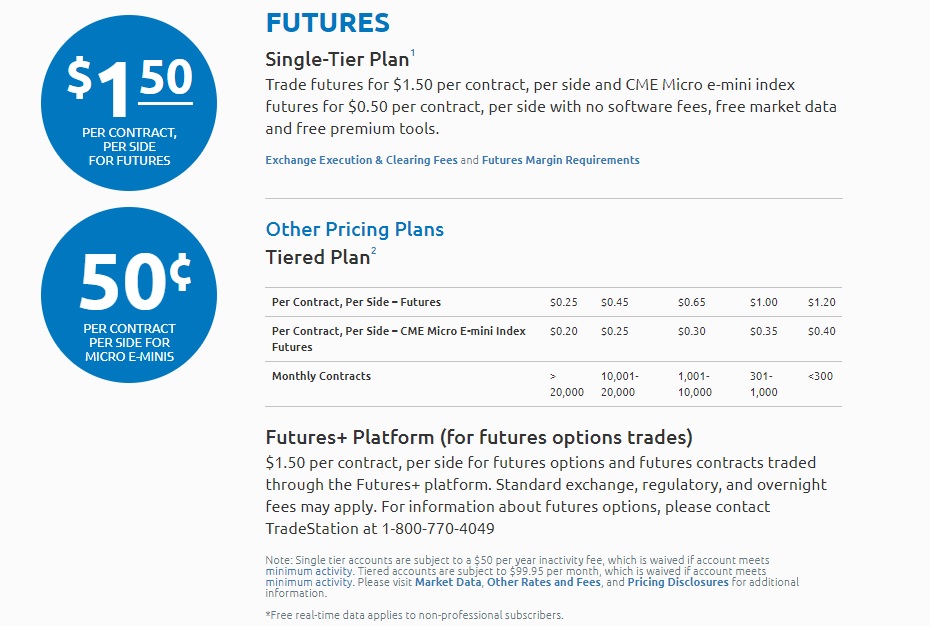

For futures trading, TradeStation charges a commission of $1.50/contract/side, while for the CME Micro e-mini index futures, the commissions are $0.50/contract/side.

The broker also has other combined pricing plans, which we have illustrated below.

You can also trade in mutual funds, corporate, government, and municipal bonds. We have illustrated the commissions for these products below.

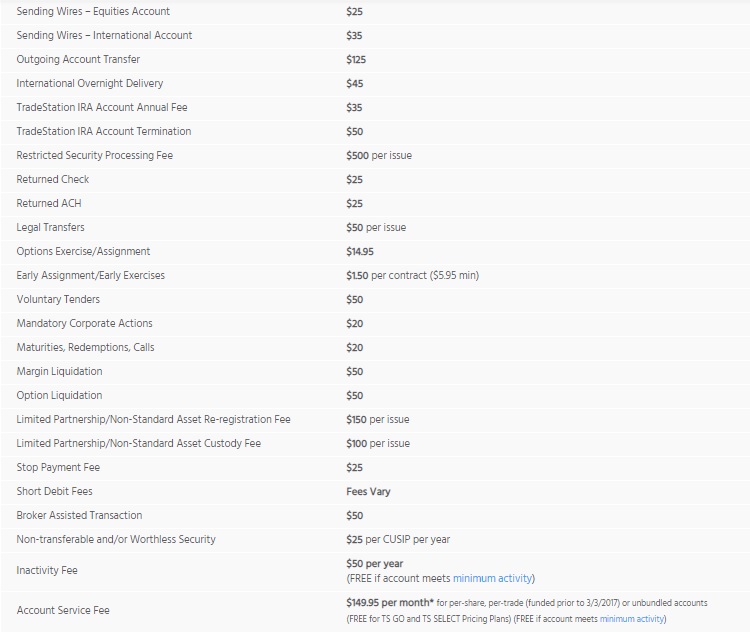

When it comes to fees, TradeStation does not charge for the software, market data, and premium tools, but there are quite a few additional charges, which we have listed below.

- A fee of $0.004 per share for directly routed orders <10,000 shares and a further $0.0005 per share if the order size is >10,000 shares.

- An annual fee of $50 would apply if the average monthly equity balance is below $2,000, or the client has failed to place less than five trades in the previous 12-months.

- A clearing fee of $0.0002 per share is chargeable on every transaction.

- A minimum fee of $1 per order up to 100,000 shares traded in a month/ a minimum fee of $0.70 per order up to 1 million shares traded in a month/ a minimum fee of $0.50 per order if the monthly volumes exceed 1 million.

- For index options, there is a fee of $0.50/contract plus an additional $0.50/contract for direct routing orders.

Illustrated below are some of the other fees charged by TradeStation-

TradeStation Global account-

The commission structure for clients

Deposits/Withdrawals-

TradeStation broker has multiple deposit and withdrawal methods, where clients can transfer not only cash but also securities held at another financial institution. Besides, TradeStation’s minimum deposit requirements on the initial funding ensure only serious customers would open their trading account with the brokerage.

Awards & Recognitions received by TradeStation-

TradeStation broker is a popular online broking firm among individuals and institutions and is mainly known for its state of the art trading platforms and low brokerage charges. Due to their unabated commitment to empowering the active trading community with their analytical tools, the brokerage has received numerous awards and recognition in recent years.

We have listed some of the awards received by TradeStation in recognition for its exemplary products and services-

2019- Ranked one among America’s Top 5 Online Brokers overall and one among America’s Top five day- trading platforms by Investopedia.

2018 – Best Platform for frequent trades and options traders by Barron’s Magazine.

2017 – Best Platform Technology and #1Broker Innovation by Stockbrokers.com

2016 – Winner of 5 Major TASC (Technical Analysis of Stocks & Commodities) awards.

TradeStation Bonus & Promotions

TradeStation keeps offering various promotions to their clients and prospects from time to time.TradeStation Promotions help them to acquire new customers and help them to stay relevant in the brokerage world. It also helps in retaining their existing customers.

Interest Sharing-

TradeStation offers customers interest on their TradeStation deposits lying in their TradeStation brokerage account. The fee varies from 0.55% to 0.3 %, depending on the balance. However, to qualify for this promotion, one needs to have a minimum TradeStation deposit of $250,000.

Cash Rewards-

One can get cash rewards credited up to $2500 when they transfer funds into their TradeStation brokerage account. The following table illustrates the qualifying assets and the corresponding cash rewards

| Cash Reward | Qualifying Assets |

|---|---|

| $100 | $25000 |

| $150 | $50000 |

| $250 | $100000 |

| $600 | $200000 |

| $1200 | $500000 |

| $2500 | $1000000 |

Stock Lending Programme-

TradeStation customers can lend their fully paid stocks or Excess Margin stocks and earn 30% of the interest earned on the same.

Honoring the Military-

TradeStation does not charge a commission on stocks, ETFs, and options for Active Army personnel, Veterans, and First Responders in honor of their services. TradeStation provides a comprehensive Educational Program depending on their knowledge levels.

Support Services @ TradeStation-

Customer support at TradeStation is available over Live Chat, Call Back & Email. Live chat is available from Monday to Friday -9am to 5 pm ET. Call & Trade facility is also available at TradeStation. Tabled below are the various contact details for client support services offered by TradeStation-

| sales@tradestation.com | |

| Phone –New Accounts | 800.770.4049 or 954.652.7677 |

| Phone-Client Support | 800.822.0512 or 954.652.7900 |

| Call a TradeStation Specialist | 800.808.9336 |

TakeStock Research is a pioneer in financial market research and content management. Backed with decades of experience in the global financial markets, we have what it takes to create compelling content on the markets. We have successfully prepared and delivered 1000’s of well-researched articles and blogs for our global clients. Our strengths include fundamental-technical analysis, derivatives, e-learning, preview/ review of corporate announcements and global economic events. We also cover topical news, podcast interviews, comprehensive forex, CFD broker reviews, besides testing, reviewing FX/CFD trading platforms, and cryptocurrencies bots. Our clients include individuals, prominent financial & educational institutions, FX brokers and advisory firms.