Options Strategies

Our out of the box options trading strategies are developed keeping in mind the various risk parameters associated with constant changes in options pricing as a result of volatility and time decay in the underlying. We have developed short- term strategies which are usually a combination of calls, puts and options writing. The underlying instrument in all our options strategies is currently limited to the NIFTY INDEX.

Features

- Compiled based on- Near- term outlook

- Max. holding period- 10 days

- Strategy- Combination of long & short options

- Risk- reward ratio- Substantial

- Strategy risks- Appropriately measured

- Max. downside/ strategy- 5-7 percent of capital allocation

- Profit- loss ratio- Greater than 70 percent

- Set up after extensive research

About

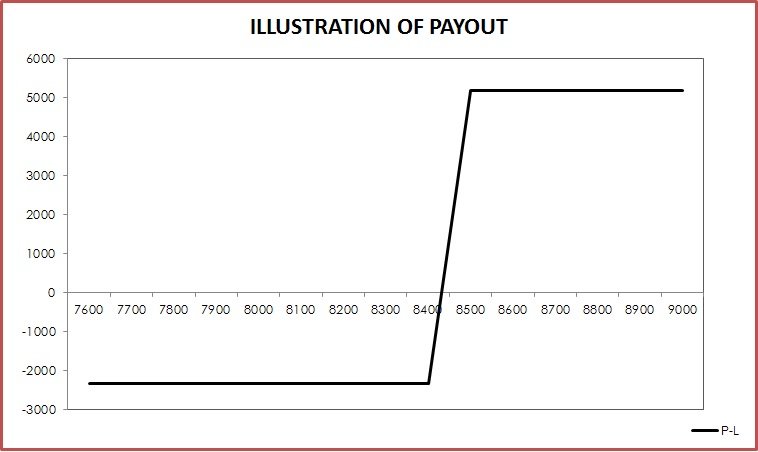

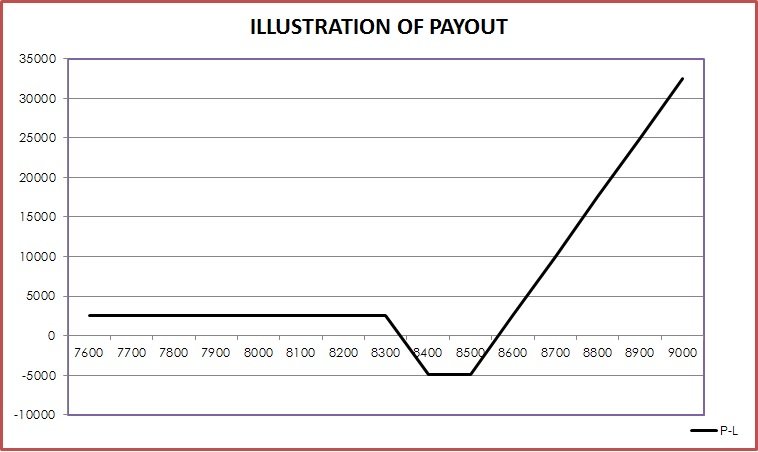

The strategies are a mix of bullish, bearish & market neutral, which are sent out after undergoing in- depth analysis of the market outlook in the near- term. The strategies are exposed for a very short- time; stretching anywhere between 1-10 days and we employ all tools at our disposal to analyse the near term trend of the underlying NIFTY INDEX which aids us in shaping the precise strategy to deploy. Each strategy comprises of anywhere between 3-5 options at varying strike prices depending on our analysis of the Index over the next few sessions..

Although we ensure that the downside risks are sufficiently contained in the event of unprecedented volatility arising due to unforeseen domestic and global events, we safeguard our strategies by setting the max. draw- down to anywhere between 5-7 percent of the invested capital on each & every strategy we deploy.

.jpg)

Blog Posts

Tags

NEWSLETTER

GET IN TOUCH

- TakeStock Research

# 802, Ground floor, 14th Main, 18th Cross,

A- block Sahakarnagar (Near Kanti Sweets),

Bangalore: 560092 - Phone: +91-96-06600877

Cell: +91- 9008760877; +91- 9008748877 - Email: support@takestockresearch.com