Trading Systems

Eyeing a strategy that has outperformed the most widely traded derivatives Index in India, by a substantial margin! A robust trading system that can generate positive cash- flows in real- time trading, regardless of the broad market trend!!

Check out our state of the art “RIG Trading System,” a proprietary day trading system sending out daily signals on NIFTY FUTURES. The system is a quant- based application designed for traders fascinated with the equity markets but do not have the resources to monitor market moves constantly.

Looking to own a proprietary trading system / expert advisor!! Your search ends here..

You can purchase one of our trading systems exclusively designed and tested in LIVE MARKETS

ABOUT OUR PROPRIETARY SYSTEM

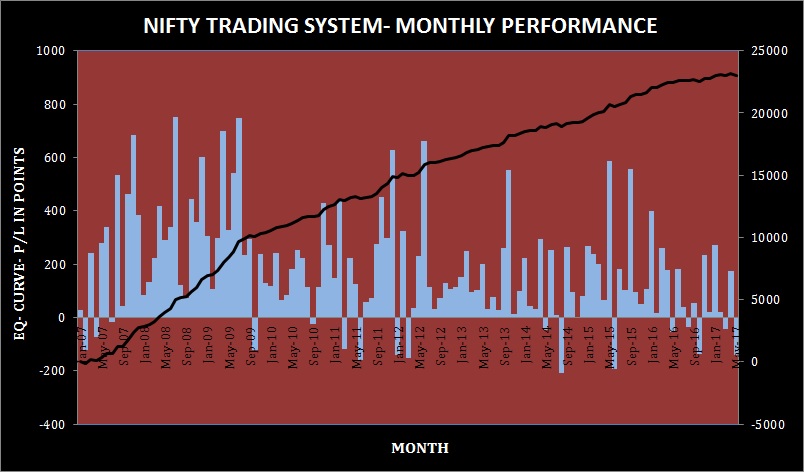

The RIG- Trading System is a quant- based application for the Indian equity markets and is currently presented for NIFTY FUTURES. The TRADING SYSTEM, back- tested from 2007 gives out long- short, day trading signals at the market open. Currently, the daily transactions are limited to 1 (one) trade: Entry+ Exit, with corresponding stop losses. All open trades are inevitably closed out prior to the end of the day’s session.

We have invested substantial time and resources to develop, test and evaluate the performance of the signals. The system has produced outstanding results in real- time environment and we are more than willing to share our P-L statements with prospective subscribers.

Features

- Day- trading system- Back- tested from 2007

- Trading in LIVE markets- About 2 years

- Win- loss ratio- Around 60:40

- Consecutive monthly losses- NIL

- Max. monthly losses in a year- Three

- Consistent average yearly profits- More than 1000 points

- Average trading frequency- 65- 70 percent of the trading days

- Max. slippages- Below 5 trades a year

- Max. drawdown- Under 300 points for the last 7 years

- Sharpe ratio- 1- 3 for the last 10 years

- Equity curve- Plotted after debiting brokerage charges and taxes

Blog Posts

Tags

NEWSLETTER

GET IN TOUCH

- TakeStock Research

# 802, Ground floor, 14th Main, 18th Cross,

A- block Sahakarnagar (Near Kanti Sweets),

Bangalore: 560092 - Phone: +91-96-06600877

Cell: +91- 9008760877; +91- 9008748877 - Email: support@takestockresearch.com