- Posted bytsradmin

- Financial Content Writers, Content Writing- Forex Markets, Corporate Training in Financial Markets, Stock Market Content Writers, Forex Content Writing, Financial Market Content Writing

- 0 Comments

Bank of England stays PAT in August

Sterling slips close to 1.3000 versus the greenback after the UK Central bank lowers GDP guidance for 2017..

Pound Sterling dropped versus the dollar after the Bank of England decided to leave the benchmark interest rates unchanged at record lows of 0.25 percent, following its monetary policy meeting on August 2nd 2017. The Central bank last revised the interest rate policy in August 2016, when the key rates were lowered from 0.5 to 0.25 percent.

Based on the Central Bank’s assessment of the UK economy, growth is expected to be muted until later this year when income growth expands to keep up with consumer inflation thereby boosting consumer spending which has remained subdued over the last few months. Inflation is expected to rise to 3 percent by October this year, overtaking the nearly three year highs of 2.9 percent seen in May 2017. The UK Central Bank also cut its 2017 GDP forecast to 1.7 percent from 1.9 percent.

Economic growth in the UK has been a concern ever since the Sterling crashed by about 20 percent following the Brexit referendum in June last year. Although the UK economy did not feel the impact of the referendum straight away, signs of weakness started to emerge from January this year as a depreciated currency led to higher inflation, raising the cost of imports and with wage growth not keeping pace with rising costs, household spending took a beating.

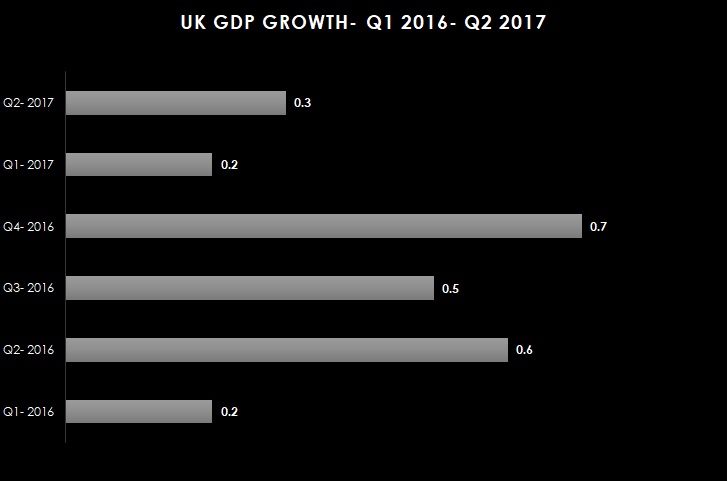

In Q1 2017, the UK economy stumbled with GDP growth rising at a slow 0.2 percent, lower than any other country in Europe with France and Greece expanding at the slowest pace in the 28- nation European Union at 0.4 percent respectively.

Things were not very different in the second quarter as the UK GDP continued its sluggish growth, rising 0.3 percent during the quarter, expanding at a slow pace of 0.5 percent in the first half of 2017, compared to a 0.8 percent growth in the first half of 2016.

Currency Outlook-

GBP/USD:

The pair slipped from 11- month’s highs of 1.3264 to end the week at 1.3035, closing below key technical points at 1.3060. The near- term trend remains bearish unless Sterling pulls back above these levels in the next 1-2 sessions. A close above 1.3060 will be positive for Sterling with near- term targets of 1.3150 followed by 1.3300. However, if Sterling slips below 1.3000, the downside could extend to the previous lows at 1.2930 followed by 1.2825- 1.2850.

Look to short the pair ONLY below 1.3000

GBP/EURO:

Sterling is close to the October 2016 lows versus the EURO. The near- term downtrend continues to persist with the pair holding near key short- term supports at 1.1050. Although the levels were breached in the last two sessions, Sterling pulled back to close above the supports, but a breach of 1.1025 could lead to sharp fall with the pair likely to hit supports at 1.0875- 1.0900.

Short- term traders can look to go long at 1.1040- 1.1050 with stops at 1.1025 for targets of 1.1200. However, if the pair breaches 1.1025, reverse positions with stops at 1.1060 for near term targets of 1.0875- 1.0900