- Posted bytsradmin

- Corporate Training in Financial Markets, Stock Market Content Writers, Financial Market Training in Bangalore, Forex Content Writing, Financial Market Content Writing

- 0 Comments

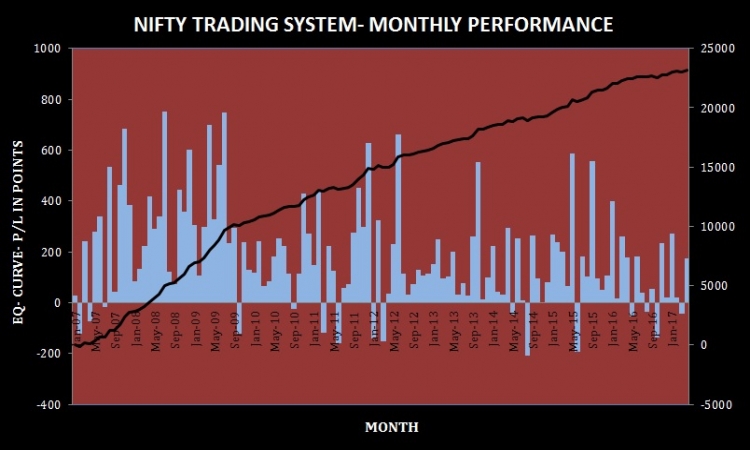

Trading Systems- Indian equity markets

Take a look at the features and the latest review of our day- trading system for Nifty futures..

Our trading systems are quant- based applications currently presented for Nifty futures. We have developed the systems for the potentially large number of traders on the Indian equity markets specifically for clients with a hectic schedule thereby leaving them with very little time to constantly monitor markets. It is also a semi- automated alternative for your trading requirements.

Features-

The system generates long/ short; day trading signals, preceding the market open & prompts if a trade should be placed as a market/ limit order along with the corresponding stops. The outcome of a trade can either be one of the following-

- Profits

- Losses

- Stopped out

The system has a win- loss ratio of around 60:40 and the back- test results from January 2007 has shown that the system has consistently generated profits of more than 1000 points (1000* 75= 75,000) per annum, year after year. The best performance was plotted in 2009, with profits in excess of 3800 points & the worst yearly performance was in 2014 with profits of 1032 points. Based on our live trading experience, slippages are very, very minimal; around 3- 5 trades a year.

Sharpe ratio-

- Averaging 1.8 for the last 10 years

- Max- 2.87 in 2008

- Min- 1.05 in 2014

Trading principle and capital requirements-

The trading signals are valid only for a particular trading day and trades are limited to 1 (one); (entry+ exit). On an average, trades are triggered on 65- 70% of the trading days; that’s approximately 12- 16 trading days in a month. All entries include stops with the profit target left open. Trades are auto squared off by the broker at 3.15PM- 3.25 PM; if placed as a MIS or cover order.

- Capital requirement- Rs. 100,000 per lot

- Min. historical annual profits- Rs. 75,000 per lot

Historical trends have indicated a maximum drawdown of about 400 points in 2008. Since then, max drawdowns are in the 300- 350 points (Rs 22000- 25,000) range. That’s about 22- 25 percent of the capital invested. The smallest profit accumulated in a calendar year was in 2014 with 75 percent ROI.

Our systems are open for subscription. For additional information, you can write to us or call us on our registered telephone numbers.