- Posted bytsradmin

- Derivatives training, Equity research, Financial Content Writers, Financial markets articles, Financial markets training, Forex articles, Technical analysis training, Forex Content Writers

- 0 Comments

US markets continue to extend gains into unchartered territory

Outlook positive, but sector rotation could be the key

The US equities markets are scaling ATHs every other month as investors eye the prospects of business activity heading back to the pre-pandemic levels soon. With the rapid economic recovery, the United Nations projects the US to be the top destination for overseas investment over the next two years. Also, the Federal Reserve anticipates the US economy to expand by 7% this year, much of it due to the $6 trillion in stimulus spending and about $2+ trillion in additional savings built up by American households during the pandemic. All this paints a very rosy picture of the American economy. Still, at the same time, with inflation rising steadily, there are concerns about how long the Fed will stick to its ultra-low monetary policy stance. There are also apprehensions about the Biden administration’s proposal to raise income taxes on corporate profits, capital gains and wealthy individuals.

Since the 2008-2009 financial crisis that led global equities markets into a tailspin, the S&P 500 has dropped by more than 15% on three occasions- 2015, 2018 and 2020. The index slumped more than 35% in the last instance, briefly signalling a bearish trend reversal before recovering quickly to end the year with solid gains of about 16%.

Source: TradingView

As of mid-June 2021, the S&P 500 advanced about 16%, adding to the recovery that began in the second half of 2020. The index continues to surge, making higher highs and higher lows, even as it eeks out new ATHs from time to time.

The Nasdaq led the US stock market rally in late March 2020 after the rout in the earlier month following the UN announcement that the COVID outbreak is an international public health emergency. With the acceleration of workspace digitalisation, the technology sector has been one of the biggest beneficiaries of the pandemic. Despite the 30% drop in February-March 2020, the Nasdaq ended the year with gains of over 46% to record one of its best annual feats. Midway through June 2021, the tech index is up 14%, lagging the S&P 500 by a small margin.

Source: TradingView

The Dow Jones Industrial Average was easily the biggest loser among the three primary US indices. The airlines, industrial, financial, real estate and building materials stocks were the biggest casualties of the COVID pandemic, leading the index to a massive 38% slump in February-March 2020. Although some sectors partially rebounded in Q4 2020, leading to new ATHs in December, the DJI lags the S&P 500 and the Nasdaq. Interestingly, the “old economy stocks” are making a comeback this year on the back of the massive vaccination drive leading to the gradual opening up of the economy.

As of mid-June 2021, the Dow has gained more than 12% this year. Although the index is lagging both the S&P and the Nasdaq, the latter is underperforming the DJIA from mid-April 2021-mid June 2021. The trend indicates that investors are shifting from high-growth stocks to value picks.

Source: TradingView

Sectoral performance-

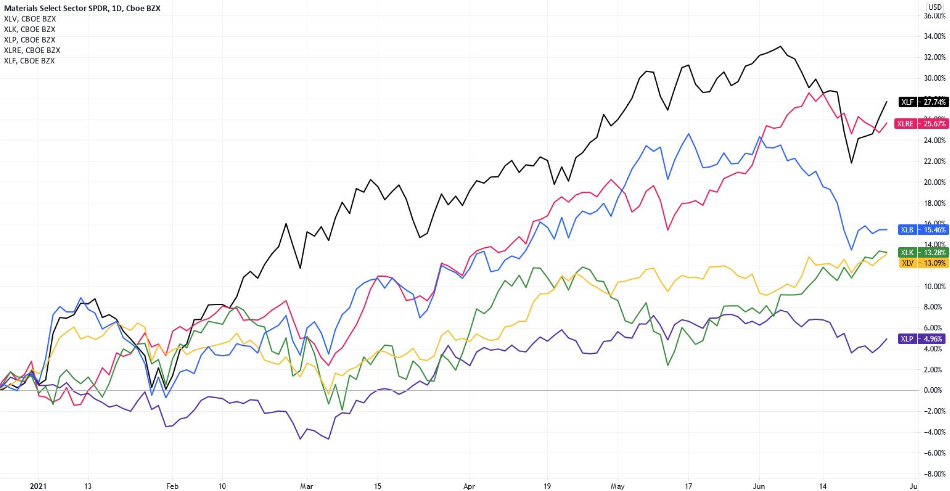

The sectoral chart below shows the performance of the financial (XLF), building materials (XLB), real estate (XLRE), healthcare (XLV), technology (XLK), and the consumer staples sectors (XLP). A close look at the chart from March 2021-June 2021 indicates that the financial, building materials, and real estate sectors outperformed others.

Banks and financial stocks, categorised as value stocks, are among the leading sectors that could outperform the others in 2021. The basic materials sector is robust, indicating that the economy is in an uptrend and the supply-demand equation for basic materials is favourable. In addition, the home building activity in the US is healthy, and the home sales numbers have also been robust. So, although there are talks about supply constraints, the data doesn’t really point towards it.

Source: TradingView

Inflation & Interest Rates-

The massive stimulus spending by the Fed appears to have led to a surge in inflation. The US Dollar Index has been on a downtrend for the last 12 months. It touched a high of 102 in March 2020 before falling to 90 in May 2021. A weaker dollar is positive for commodity prices, and these have jumped significantly since the March 2020 market crash. Oil, silver, corn, copper, natural gas, and soybean have jumped by a whopping 70% or more from April 2020-June 2021. Oil prices are back to their pre-pandemic levels and could gain further on the back of growing optimism that global economic activity is picking up. At the same time, the impending increase in supply from Iran and the outbreak of COVID in emerging economies are balancing the supply-demand equation.

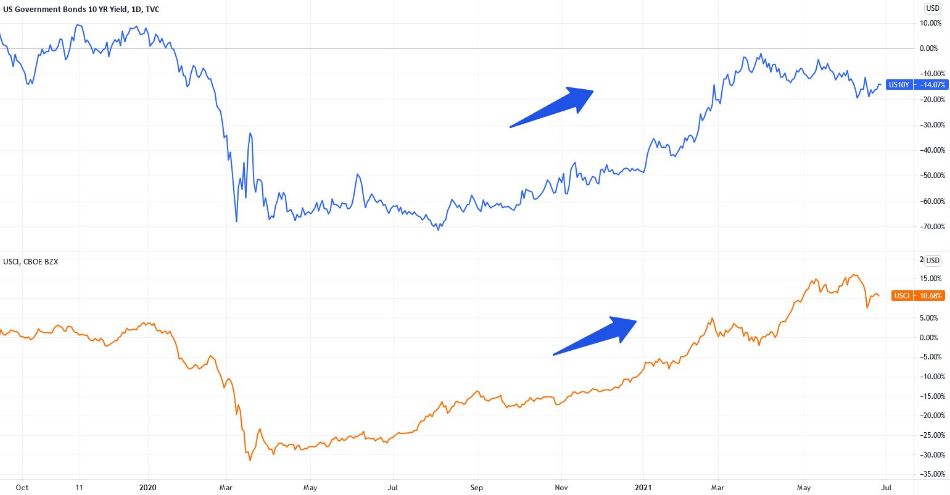

The expectations of high inflation are being reflected in rising yields. The yield on the 10-year US Treasury rose from < 0.6% in April 2020 to over 1.6% in March 2021. The rising prospects are affecting discount rates and valuations of growth stocks. Thus, the shift from growth to value seems to be playing out.

Source: TradingView (USCI commodity index)

US Employment growth-

The US unemployment rate is a key indicator of the overall market sentiment. Employment growth is positive for the markets as it indicates a more robust economy. However, the May 2021 US unemployment data wasn’t in line with expectations. The economy added just 266,000 jobs, while the unemployment rate was at 6.1%, below the Street expectations of 5.8% and an addition of 1 million jobs.

Downside risks-

The Biden administration has drawn up plans on a $2.3 trillion infrastructure spending and a proposed $1.8 trillion package on social expenditures. At the moment, it is not very clear how these spending plans would be funded. But, the markets seem to be speculating that taxes on higher-income individuals and corporates would come into effect, which are likely to be a negative for the equity markets. Secondly, the threat of COVID outbreaks in countries outside the US remains, and the emergence of new vaccine-resistant variants could negatively impact the US markets too.

Positive US market outlook-

We are clearly in an ongoing bull run in the US markets. Sector rotation is the lifeblood of a bull market, and that’s what seems to be playing out. We believe that the bull market is still healthy, and there is room for the markets to continue surging higher.

Additionally, given that the vaccine rollout is progressing well, the gradual re-opening of the economy should give the much-needed fillip to sectors that were devastated during the pandemic. Most US states are targeting a full opening by mid-summer 2021.

At the same time, we must remember that we are now entering the second year of the bull run. With some uncertainties on the horizon, this could also be the year when markets take a breather. After all, 2020 has been one of the best times for the stock market in a long time. High inflation with low-interest rates could compel the Fed to re-look its accommodative policy. But, for now, picking the right sectors and stocks in the value space should offer substantial rewards.

TakeStock Research is a pioneer in producing high-quality financial market content and research reports for financial & educational institutions. Backed with decades of experience in the global financial markets, we deliver equity research reports, articles & blog content in commodities, FX, equities and cryptocurrencies. We also review FX brokers, CFD trading platforms and cryptocurrencies bots, conduct online/classroom training workshops in three modules- Introduction to the financial markets, technical analysis and derivatives. Besides, we tutor/assist students from international universities with their finance curriculum.

Get in touch with us for all your financial market requirements